Natural gas, propane, fuel oil and electricity are at record highs. Experts say these prices are here to stay.

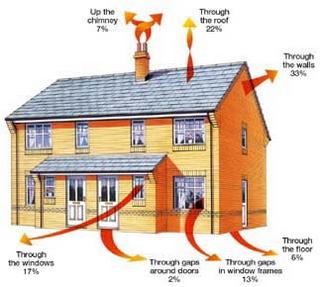

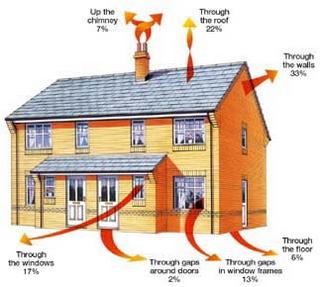

We all hate to spend money on things we can't see....like warm air, for example. Saving energy means saving big money this winter. What are the best idea's to make sure your money and your heat does not go out the window?

What can you do to keep the warm air in and the cold air out?

1) The smartest thing a homeowner can do is get their heating system cleaned and serviced.

2) Install a timed thermostat. It will turn the heat on before you wake up and before you get home from work. It will keep your home's base temperature while you are asleep or away.

3) Use wood fires or space heaters to supplement your furnance. Use a space heater to add heat only where needed for a short time, like the bathroom.

4) Why heat a room no one uses? Close the ducts or baseboards in all rooms that you don't use. Then, keep the room closed off from the rest of the house.

5) Shut all fireplace dampers when not in use.

6) Caulking and weatherstripping can cut heating bills by 10%. Usins Latex caulk with a little silicone is better than using silicone alone.

7) Putty and caulk areas where exterior siding meets window trim.

8) Old houses with weighted rope and pulley window systems can temporarily fill the drafty void that runs the entire length of the window with strips of carpet.

9) Lock your Windows. Closed windows have more drafts than a locked one.

10) Insulation, whether blown, poured or rolled makes a barrier between the outdoors and your living area. Add a thick layer of unfaced insulation to your attic floor; Use foam pads to seal switchplates and outlets; or, trace around the outlet with a pencil, remove the face plate, drill a tiny hole in the drywall between the outline and the electrical box, fill the void area's with expanding spray foam. Plan to use 1 can for every 3 outlets.

11) The Basement: Insulating the basement and sealing off drafts will make your floor warmer by 10 to15 degree's. Insulate the area in your basement between the first floor joists (sill box); Cover any exposed water pipes with foam tubes or fiberglass strips; Wrap, then seal exposed ductwork with aluminum tape; Insulate basement windows with plastic sheets; Turn off the lights and cover the windows, if you see light, squirt foam in the gaps. Even small cracks let out the warm air.

12) Jacket your waterheater.

13) Mail slots and pet doors allow heat to escape and allow cold air in. Consider using a double-door mail slot. Locate your pet door in a protected area, facing south, if possible. Consider locking your pet door and let your pets in and out during cold spells.

14) Bank your exposed foundation with plastic. Then reinforce the bank with hay bales or bagged leaves. It may be ugly, but it is a time-proven draft barrier.

15) Make sure your dryer bent stays closed when the dryer is not in use.

16) Put up plastic over windows. Or, use heavy drapes or blankets over windows. Open them during the day and close them before dark. Let the sun work for you.

When it comes to saving your cold, hard cash this winter, be smart. With money you will save in a little draft dodging, you can buy those new granite countertops in a couple of years.